DESCRIPTION: This 127.05+/- Acre Conservation Reserve Program Tract located in central Lamb County on Farm to Market 1055. This farm is relatively flat and very accessible with paved frontage down east boundary and well-maintained county road down north boundary. The farm is in an area that has various types of use of land for agriculture production including cotton, grain sorghum, wheat, and grass for haying and grazing.

LEGAL DESCRIPTION: Being a 127.05+/- acre tract consisting of all of the East 127.10 acres as described in Volume 741, Page 346 of the Deed Records of Lamb County, Texas, (as held) of Labor Thirteen (13), League 633, Abstract No. 318, Certificate No. 20, State Capitol Lands, Abner Taylor Original Grantee, Lamb County, Texas, further descripted on by Metes and Bounds on Exhibit A to Auction Sales Contract.

TOPOGRAPHY: Farm is fairly flat with relatively small slightly depressed areas in the NE part and SW parts.

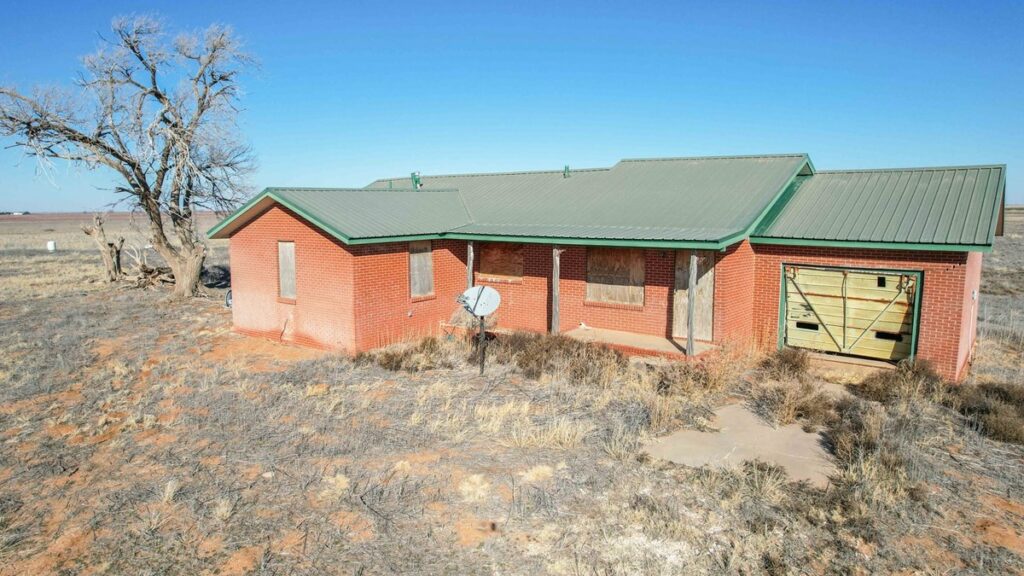

IMPROVEMENTS: There are a couple of abandoned wells on the premises, but none are currently in operation and there is no guarantee or warranty of the wells capability. There is an old house on the property that has not been lived in for approximately 10 years. Home is not considered livable in current condition as basic systems to the house including but not limited to water well are not currently viable.

WATER FEATURES: NONE

FENCING: NONE

WILDLIFE, HUNTING AND RECREATION: Area is well suited for a variety of game such as mule deer, dove, quail, crane and geese.

SOIL: Soils that comprise the tract consists primarily of Amarillo fine sandy loam, 0 to 1 percent slopes, Amarillo loamy fine sand, o to 3 percent slopes, Mansker fine sandy loam, o to 1 percent slopes, and Amarillo fine sandy loam, 1 to 3 percent slope, with minor areas of Veal fine sandy loam, 1 to 3 percent slopes and Randal clay, 0 to 1 percent slopes, occasionally ponded. Soil Map available in Property Information Packet.

USDA INFO: Farm is currently enrolled in the USDA Conservation Reserve Program (CRP) through September 30th, 2031. Acres enrolled are 118.22 with an annual payment per acre of $48.45 or an overall annual payment of $5,728.00. FSA-156 available in Property Information Packet with details about base acres.

TAXES: 921.67 (2024 w/exemptions)

TITLE RESERVATIONS: Seller warrants that this Property will sell without Title reservations related to wind, mineral, or solar.

EASEMENTS: The sale of the property is subject to any and all easements filed of record.

FURTHER REPRESENTATIONS: See Auction Terms and Conditions for futher information:

All information provided is believed to be accurate; however, no liability for its accuracy, errors or omissions is assumed. All lines drawn on maps, photographs, etc. are approximate. Buyers should verify the information to their satisfaction. Information is subject to change without notice. There are no warranties either expressed or implied pertaining to this property. Real estate is being sold “As-Is, Where-Is” with NO warranties expressed or implied.

COMMENTS: Please call Monty Edwards to plan to view the property at 806-786-5426 or email him at monty@medwardsland.com.